by Fabiola Castro | Mar 28, 2025 | Miami Real Estate

Miami’s real estate market is evolving, and Cove Miami is set to redefine luxury waterfront living. This exclusive high-rise development offers unparalleled elegance, breathtaking ocean views, and world-class amenities in one of the city’s most desirable locations. A...

by Fabiola Castro | Mar 27, 2025 | Real Estate

The Florida real estate market in 2024 experienced fluctuations driven by economic conditions, interest rates, migration trends, and climate-related challenges. With a mix of opportunities and risks, buyers, sellers, and investors had to navigate a dynamic...

by Fabiola Castro | Mar 14, 2025 | Miami Real Estate

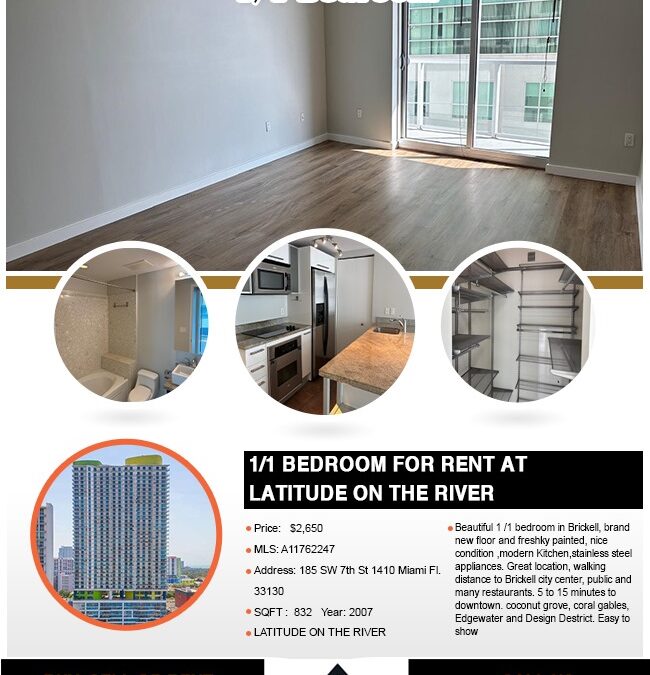

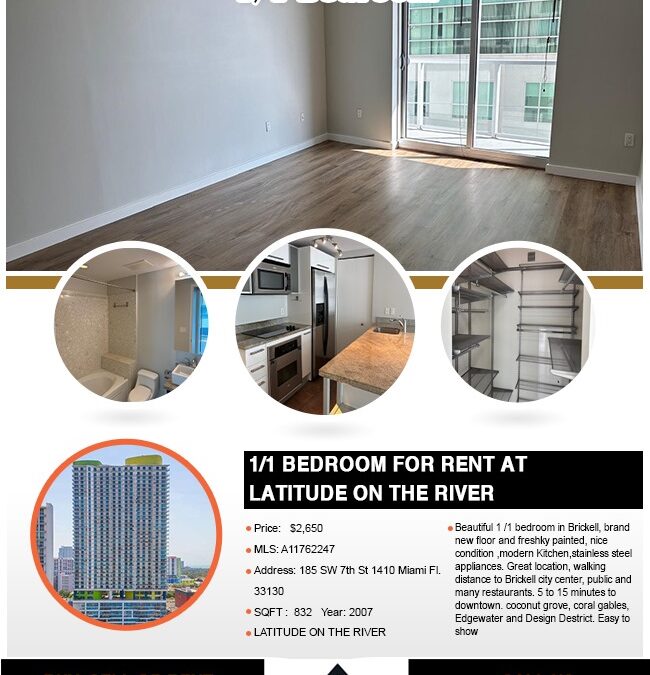

Here’s a clean and well-structured rewrite for your website listing: Beautiful 1-Bedroom Condo in Brickell – $2,650/Month 📍 185 SW 7th St #1410, Miami, FL 33130 📌 MLS#: A11762247 | Status: Active | Available: 03/12/2025 Property Details: Rent: $2,650/month Bedrooms: 1...

by Fabiola Castro | Mar 10, 2025 | Miami Real Estate

Hedge fund giant Citadel, led by billionaire Ken Griffin, is set to transform Miami’s skyline with its new 54-story headquarters at 1201 Brickell Bay Drive. Foster + Partners designed this iconic glass tower, which will redefine Miami’s financial district. Key...

by Fabiola Castro | Mar 7, 2025 | Miami Real Estate

Welcome to the latest Latitude on the River market update for February 2025! Whether you’re looking to buy, sell, or rent a condo in Miami, this report provides the most recent pricing trends and market activity to help you make an informed decision. Latitude on...

by Fabiola Castro | Mar 5, 2025 | Real Estate

Introduction The Florida real estate market in 2025 continues to be a dynamic and attractive investment opportunity, particularly in Miami. With the latest economic policies under President Donald Trump’s administration, including trade tariffs, immigration reforms,...

by Fabiola Castro | Feb 26, 2025 | Real Estate

As of February 2025, Florida’s real estate market exhibits a mix of stabilization and growth, with regional variations influenced by factors such as inventory levels, buyer demand, and infrastructure developments. Statewide Trends: Home Prices: The median home...